The "50/30/20 Rule" of Personal Finance

Word of the WeekP/E Ratio: The price-to-earnings ratio (P/E ratio) is the ratio for valuing a company that measures its current share price relative to its earnings per share (EPS) and is used by investors to determine the relative value of a company's shares in comparison to a company of differing or similar size.

Read on at Investopedia

In spite of having a long white coat and the word "Doctor" at the front of my name, nothing could cover up the fact that I was an idiot when it came to managing money.

I blame my wife and friends for my economic misfortunes. Clearly I was the one doing all of the excessive spending. No one approached me and said, "hey man do you need another pair of Nike's?" or "certainly you don't love Texas Roadhouse this much, right?" All joking aside, my spending habits were so terrible, that if I failed to redeem myself by sticking to a budget, I was headed for economic ruin regardless of my salary.

If you want to read about how I struggle bussed through medical school, check out my blog post below.

Searching for a solution, I came across the 50/30/20 rule. This system is simple, so I will keep it brief. First, you may be wondering, "what is the 50/30/20 Rule?"

Under this rule, 50% of your income goes to your needs, 30% to your wants and 20% to savings and investments. Now that we have an idea of what it is, let's get started.

Step 1: Track Your Expenses!

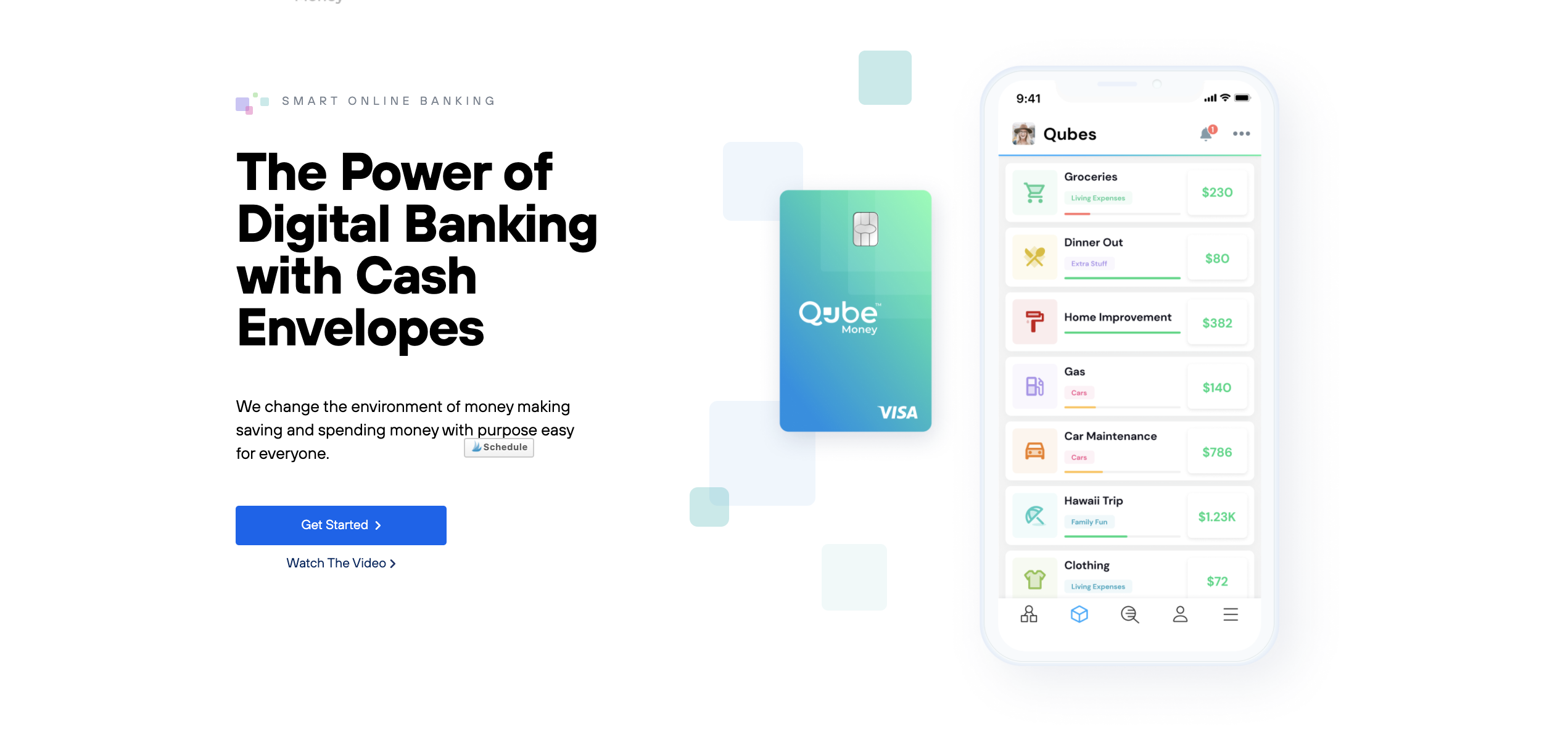

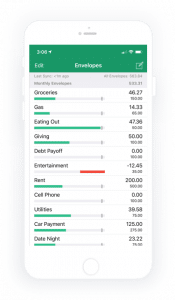

To begin the process of budgeting, tracking expenses is paramount. Although many physicians have blessed with photographic memory, the ease of swiping a credit can sometimes lead to a gross underestimation of your spending. I personally use google sheets to track expenses but there are plenty of handy apps to assist with managing outgoing expenses ( I have included a list of some at the end).

Once you have found your budgeting tool, you can move on to step 2.

Step 2: Fill out your budget.

Start by populating your budget with all of your projected expenses. Fill in your fixed expenses first as these items do not change by nature.

Items in this category may include:

- Housing

- Food

- Utilities

- Transportation

- Insurance

- Minimum Balance on Debt payments

- Subscription services

- others

Next, fill in the flexible or variable expenses. The most notorious member of this category is food as coffee trips and eating out can rapidly erode your budget. Now that your budget is filled out, its time to move to step three.

Step 3: Weight your budget

Divide your budget into three separate parts; Needs, Wants and Savings/Investing. In order to be at goal, no more than 50% of your take home income should go to your needs, 30% for wants and 20% to savings.

If your budget is within these parameters, move on to Step 4. If this is not the case, you will need to trim the fat. The method taught by the James Dahle, The WCI, is to separate your expenses into fixed and variable costs. Variable costs such as utilities can be addressed by simply decreasing your usage as much as possible. This may mean shorter showers and mindful electricity usage which can appear cumbersome initially, but you will be surprised by how much money you can save annually by making some adjustments.

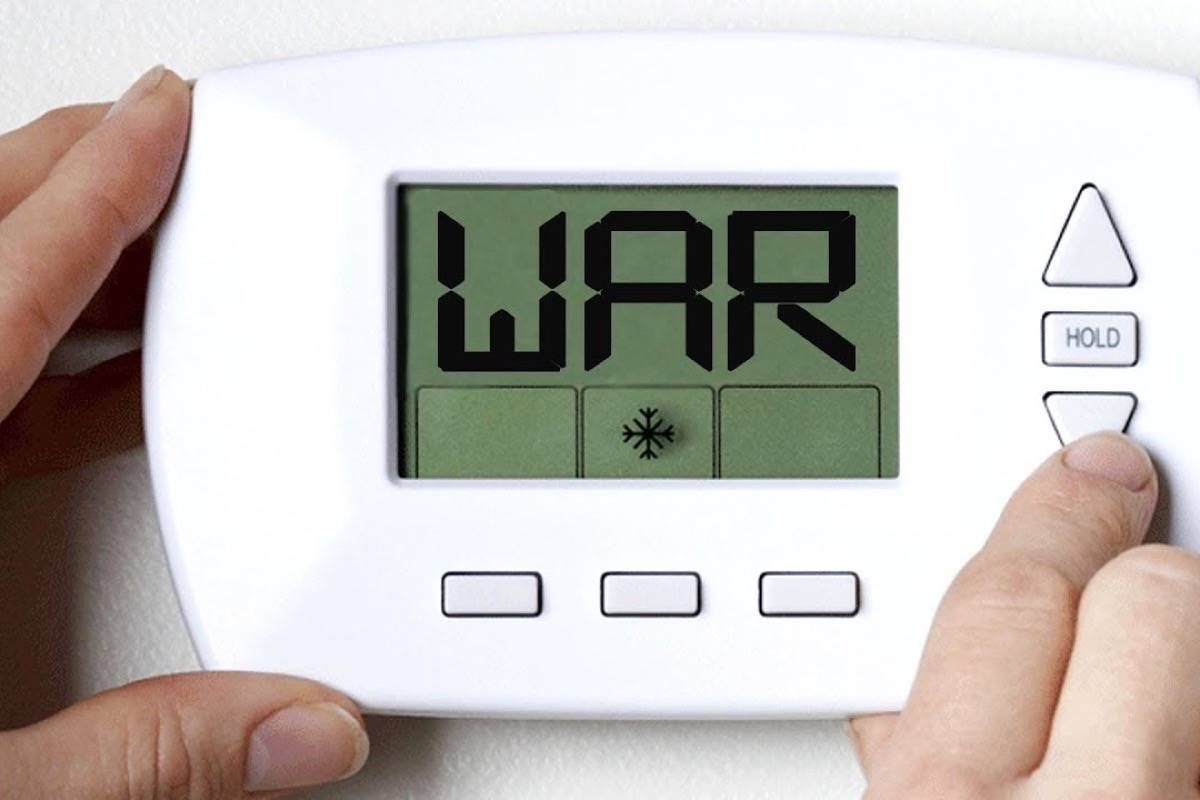

Last winter, our electricity bill reached 600$ which is approximately four times as expensive as it normally is year round. Our heat usage was the culprit. I saw this as an opportunity to convince my wife that we needed to keep the house freezer cold, my favorite indoor temperature. Since I'm terrible at the art of thermostat persuasion, I was met with prompt rejection.

Luckily, we were able to compromise and we lowered the temperature on the thermostat and opted to use a space heater in whatever room was in use. This small change led to a reduction in our energy bill by 50% the following month. We will certainly use the same strategy this year to pocket some additional cash.

Lowering flexible expenses can be a headache, but it will likely pose less of a challenge than adjusting fixed expenses, which can sometimes require seemingly heroic efforts to pull off. These efforts may include, house-hacking or downsizing to a cheaper residence, getting rid of a vehicle lease. In dire straights, you may find that you have to go full Dave Ramsey and revert back to the ol' trusty flip phone.

Once you have your budget at or near the 50/30/20 cutoff, its time to move on to step 4.

Step 4: Optimization

Although 50/30/20 is a great start, this is only the beginning. Your budget will certainly need fine tuning. Similar to the second part of Step 3, it's time to trim the fat.

- Identify any fixed and variable expenses that can be adjusted or eliminated altogether.

- Take the recovered cash and use it to pay off debts faster or add it to your saving and investing category.

Step 5: Have fun!

The road to financial independence is tough, as it requires tremendous discipline. However, it doesn't have to be boring! Don't forget to reward yourself a little along the way when you make strides in the right direction. Good luck on your financial journey!

Take a look at the White Coat investor's article on Physician millionaires

Check out some of these budgeting tools: