Hey Dummy, It's Time to Get a Budget

A pocket dummy is one who mindlessly spends money unfazed by the iminent long term financial consequences

Antonio, the Pocket Dummy

"Can you please spare a little change ma'am?" Many would suspect this phrase originated from a sweet person down on their luck. Unfortunately, this is the statement my broke ass made to my future wife at the tail end of medical school. Super smooth right? Nah, not in the slightest. I was living paycheck to paycheck and finally interview season had spread my pockets too thin to cover my expenses for the rest of the year.

Luckily, we had been saving money together to build better habits (actually I was stashing money at her place because my hand and brain had a difficult time understanding the term "savings."). This meant however, that my savings would go all the way back to zero. It was an embarrassing circumstance, but what did I expect? I was aimlessly swimming through life, akin to the simple character of Dory from Finding Nemo, except reality doesn't often award the unprepared with obscene amounts of serendipity. The aimless and unprepared such as myself wouldn't be so lucky. My problems with personal finance did not begin overnight. They began the very first time I bought food. This is a bad way to start. At one point I was going out to eat so much, that I was literally eating and eventually pooping and flushing away my opportunity to become financially independent.

I had a very short term oriented way of thinking when it came to money that can be summed up quite simply, I underestimated my ability to overindulge, and overestimated my ability to afford it. I ignored it for majority of adulthood hoping that a increase in pay would solve my problems. However, I knew that if I didn't address these issues as a resident, I would succumb to the law of The Notorious B.I.G. AKA lifestyle inflation, and have more money, yet more problems. These problems can grow exponentially when factoring when others are impacted especially when it's a spouse and/or children such as it was in my case.

Therefore, I committed to taking meaningful strides toward building and implementing a financial plan. So far, our plan has been mainly self directed using my hospitalist groups financial advocate, an experienced a trusted Certified Financial Planner as well as resources such as white coat investor, one of a number of books on my Recommended Reading List. I found it pretty easy to complete the steps in my financial plan that required relatively little effort to implement such as getting disability and life insurance, creating a student loan plan and adjusting my retirement contributions

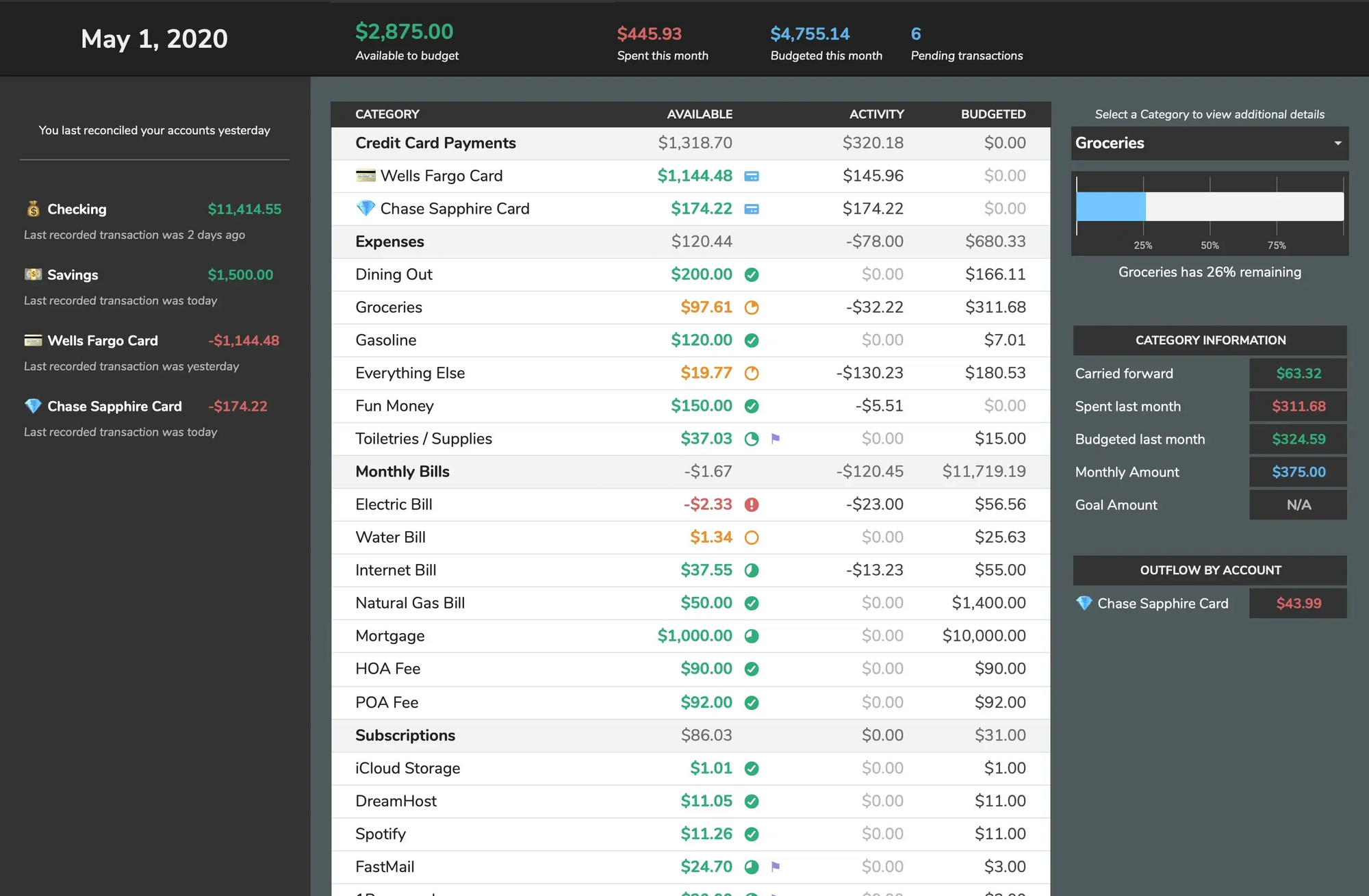

On the other hand, I struggled greatly with creating and sticking to a budget. To be honest, I still do but blogging and having monthly financial meetings with my wife have driven me to be more consistent and heightened the urgency/importance of my efforts. Currently we use a spreadsheet to forecast a monthly budget using the "envelope system" a budgeting style that physically or digitally portions out funds into different spending categories. When the envelope reaching zero, your spending is done in that category unless you transfer the funds from an overfunded expense category.

Financial meetings ran a little slow at the beginning as we hit snags when calculating totals for spending categories. Now we have cut time by downloading csv files from our banks and calculating the totals in our spreadsheet using equations. I admit that spreadsheets budget may seem dated to some and require more work to maintain than an app. Surprisingly, maintaining a spreadsheet for our budget has made me more present when making spending decisions because when you enter =SUM(B1-B20) and it equals ~250 dollars in coffee charges at donut bank, it means one of two things, their coffee is damn good, and that you made the same mistake over and over again (outlined in column B rows 1 through 20).

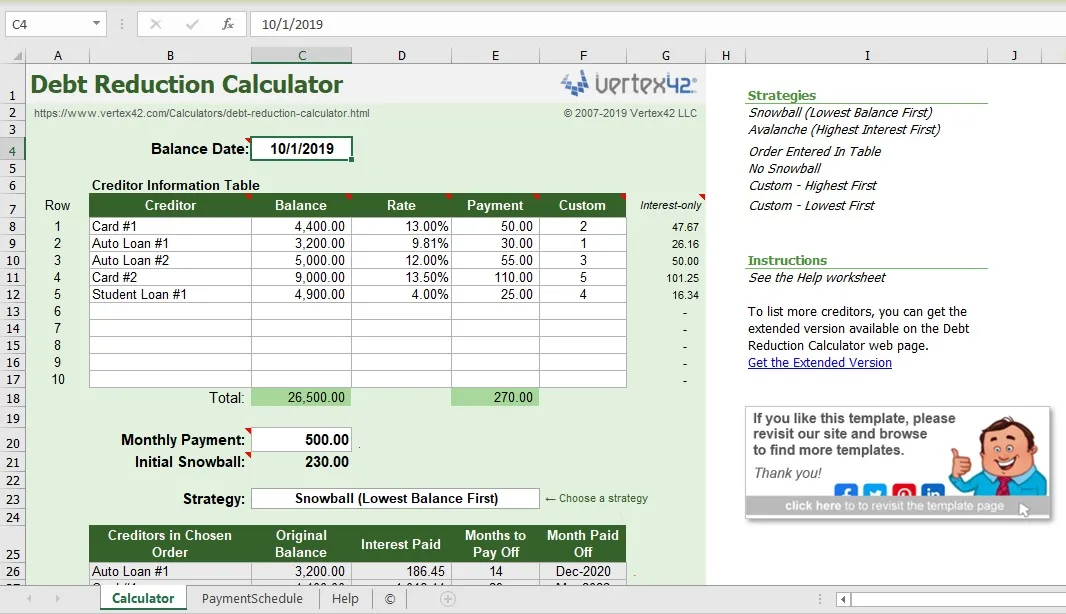

Our currently our budget sheet consist of three parts, one is for tracking our monthly budget using a template for an unnamed instagram fake guru. The next part come from a debt snowball template we found with many others on vertex42.com. The template allows you to list your loans including the loan amount, interest rate and the maximum you can allocate to the snowball. It calculates how long you will have to make payments before it's paid off and tabulates the payment schedule showing the interest and principal amounts remaining every month until its fully paid off.

There were a few other trackers that caught our attention:

This is another spreadsheet but includes so many features including automatically generated reports the exam your net worth or trends in categorical monthly spending. Two big drawbacks iare it bulkiness as it contains twelve spreadsheets and starting out there is a steeper learning curve than other app based budgeting tools. I personally found learning how to use the system too cumbersome and opted for the simpler template that we use now.

Although our system seems to work for now, but I haven't fully ruled out apps yet and would consider making the switch if manual upkeep with our spreadsheet starts to falter consistently. Mint and Everydollar appear to be fairly easy to use and links to your bank for automatic tracking. They have a free and premium versions which include more functionality. There is another tool called qube money that combines envelope style budgeting to banking. It comes with an app and a credit card that only works when you allocate budgeted funds to be used by the card using the app at the time of purchase.

All in all, I am very happy with the progress my wife and I have made as it pertains to budgeting and recognize that my small victories are cumulative and will create a snowball effect, benefitting my downstream goals. I hope this continue!