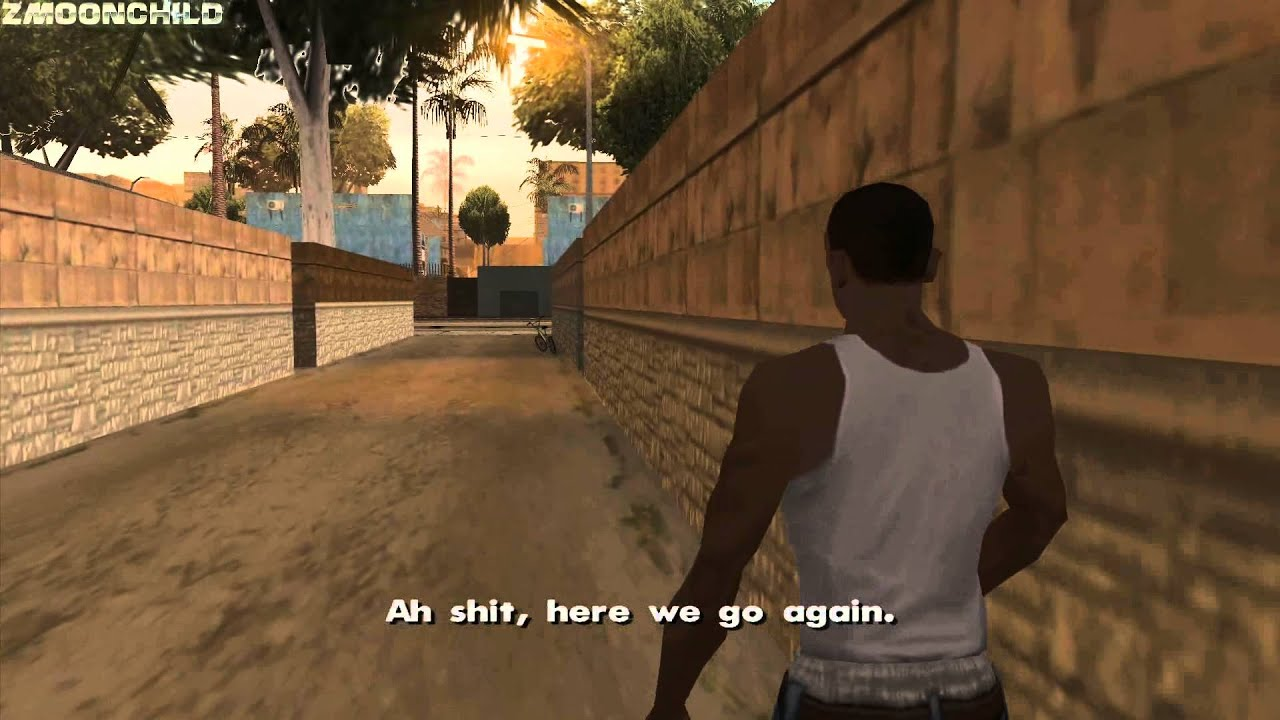

Here We Go Again... Addressing My Financial Follies

I know you're reading this thinking, "here we go again with another fake guru capping about his luxurious lifestyle and trying to convince me that he has the secret sauce to achieve wealth and prosperity." Fortunately for you, nothing could be further from the truth. I'm writing this blog with the foreknowledge that the wonderful readers on the other side of my computer screen likely have more experience in the realm of personal finance and investing than I do. My intention is to document my personal finance and investing experiences, including the successes and failures. I have two motivations behind this:

- Documenting aforementioned failures and successes will give the reader an opportunity to learn from my mistakes (there will be plenty) and benefit from any triumphs I may have.

- Documenting aforementioned failures and successes will allow me to passively hold the reader hostage 🪤 and serve as my accountability partner on my financial journey.

In this series, I wont be sharing my salary information or the cost of my expenses. I will however document the percentages that each category of expenses makes up in the whole pie as well as discuss how far over or under I am with my budget and the plans to adjust.

The initial blog will discuss my personal financial plan including:

- The budgeting tool I will be using

- The highlights of my budgeting plan

- A list of my problem areas (Which right now, is everything)

- An action plan to tackle said problem areas

Follow up quarterly check ins will include:

- Quarterly highlights

- Evaluation of problem areas, and efficacy of the proposed solutions

- Identification of new problems if any, including unforeseen or big ticket purchases, emergency expenses

- Final remarks on quarterly performance, designating a win or loss

- Action plan for the following quarter

I am starting this block series because my wife and I have been married for 2 years now and we have been blessed to have a healthy him beautiful 8-month-old son. With those blessings however, comes a heck of a lot more responsibilities... and expenses. We got married during my 2nd year of residency and we decided that 1 of the things we desperately needed to work on our financial future seeing how much marital strain comes from financial difficulties.

Initially, we were doing a wonderful job. We maintained are budget on a simple excel document in held monthly financial meetings to evaluate are compliance with our budget, identify problem areas ( which was mostly food) and solutions. We initially had great success, mainly due to are consistency with meeting month to month and genuine efforts to manage our expenses. However, his things got busy, especially with COVID, I got lazy and eventually our meetings and budget tracking grinded to a halt.

Knowing that my wife is is the champion of frugality and conscious pending in our marriage, I felt obligated to get my own financial life in order and to start pulling my weight when it comes to budgeting and spending.

Now that we are a new town, with a new home and a new addition to our family, we have decided to revisit our financial goals with hopes of decreasing are expenses to direct our newly discovered cash to paying down student loan debt and building our financial independence.

I look forward to embarking on this financial journey with you all as my partners in crime. Wish me luck!